how to declare mileage on taxes

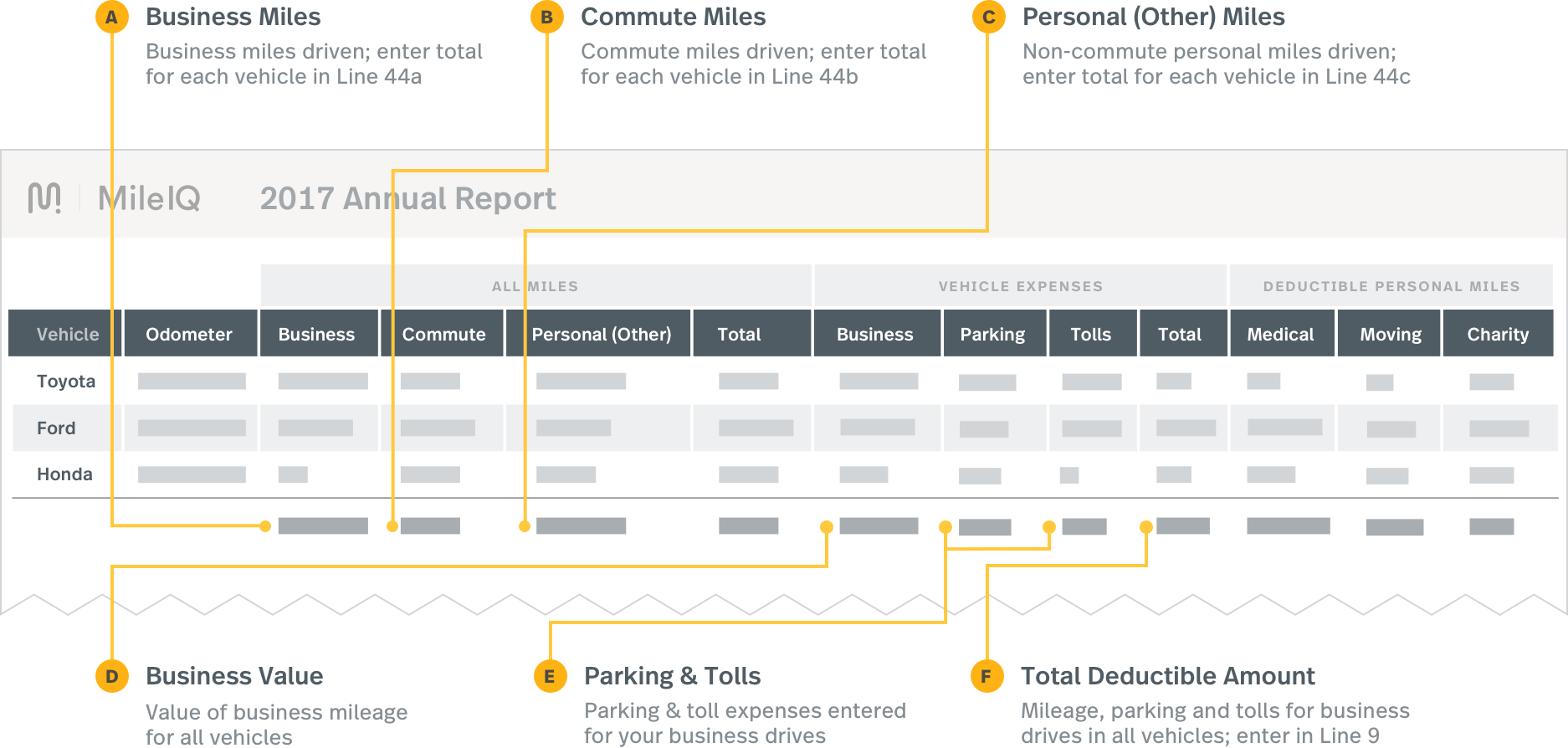

The percentage of miles driven for business purposes is also required to declare on Form 2106. In addition to providing the number of miles driven during the tax year youll also need to answer.

Free Mileage Log Template For Excel

The standard mileage rate lets you deduct a per-cent rate for your mileage.

. The IRS Standard Mileage rate is the standard mileage reimbursement rate set by the IRS each year so that employees contractors and employers. For instance lets say you drive 12000 miles in a year 5000. You can use this rate to calculate your tax deduction at the end of the year.

The standard mileage deduction. By Feb 28 2022. You need to keep track of your total number of miles that you drove during the year and the total number of miles you drove.

There are two ways to calculate mileage reimbursement. Make Sure You Qualify for Mileage Deduction. By Feb 14 2022.

If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. Do I subtract Mileage 575 cents and then take 22 of the remaining. Dashers that opted in to receive their 1099 by Postal Service or did not opt for a delivery method should receive their forms in the mail.

Track Mileage on Tax Return. Total kilometres you drove during the year Total. We will add the 2023.

Gather the total number of business miles for the year Multiply that by the standard mileage rate for 2019 Come to a mileage deduction of. How to I deduct doordash mileage from my earnings to pay Q3 taxes. Enter odometer readings from the start and finish of your journey.

If you are itemize your deductions multiply your miles driven by your driving taxes on an IRS basis. If you use the actual expense method to claim gasoline on your taxes you cant also claim mileage. Below are the optional standard tax deductible IRS mileage rates for the use of your car van pickup truck or panel truck for Tax Years 2007-2022.

HMRC rates are 45p per mile for the first 10000 miles. Your mileage deduction isnt hard to calculate if youve kept accurate records in your logbook. To determine his mileage deduction he should.

Alternately they can claim their. Youll need two figures. Determine Your Method of Calculation.

How to Log Mileage for Taxes in 8 Easy Steps 1. The best way to Create a Mileage Expense Sheet in Excel Begin Excel and choose the File tab. Self-employed individuals will report their mileage on the Schedule C form.

September 4 2020 1055 PM. If your employer pays a mileage allowance below the rate allowed by HMRC you can claim the difference as a tax relief. Self-employed workers can claim their mileage deduction on their Schedule C tax form rather than a Schedule A form for itemized deductions.

Driving 15000 miles in 2022. The standard mileage rate is easy to calculate. How Do I Calculate My Mileage For Taxes.

IRS STANDARD MILEAGE RATE. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year. For example if you drove your vehicle 1000 miles for IRS-approved business purposes in 2021 multiply 1000 miles x 056 per mile.

For 2021 that rate is 056 per mile. To do this you need to itemize your deductions instead of claiming the standard deduction. Enter your mileage expense by completing Form 2106 Employee Business.

When filing your taxes youll enter the total number of miles. Report your total gross income on Schedule C then reduce it to net income by subtracting the amounts you spent for allowable business-related expenses. If youre self-employed or an independent contractor however you can deduct mileage.

Youll be able to deduct 560.

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

![]()

25 Printable Irs Mileage Tracking Templates Gofar

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Are The Mileage Deduction Rules H R Block

How Much Tax Does A Sole Trader Pay And How Mazuma

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

25 Printable Irs Mileage Tracking Templates Gofar

Free Mileage Reimbursement Form 2022 Irs Rates Word Pdf Eforms

Learn To Log Business Mileage For Taxes Expressmileage

Creating A Mileage Log For Taxes Data Intelligence

How To Claim Mileage And Business Car Expenses On Taxes

What Business Mileage Is Tax Deductible

![]()

25 Printable Irs Mileage Tracking Templates Gofar

What Records Do You Need To Claim A Vehicle Mileage Deduction

Learn To Log Business Mileage For Taxes Expressmileage

Mileage Reimbursement Rules For Uber Drivers And Turo Owners

Mileage Tax Deduction Claim Or Take The Standard Deduction

Business Mileage Deduction 101 How To Calculate Mileage For Taxes